After tax profit margin calculator

Again lets say your revenue is 50000 and your net income or bottom line equals 8000. The two inputs we need to calculate the pre-tax margin are the earnings before taxes EBT and the revenue for 2021.

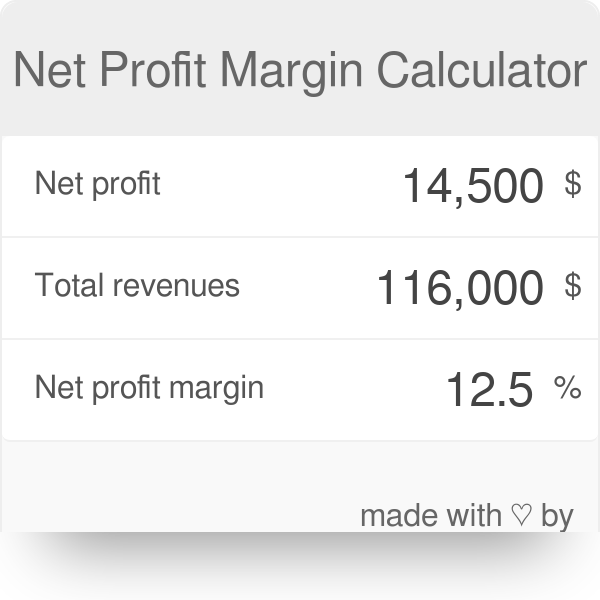

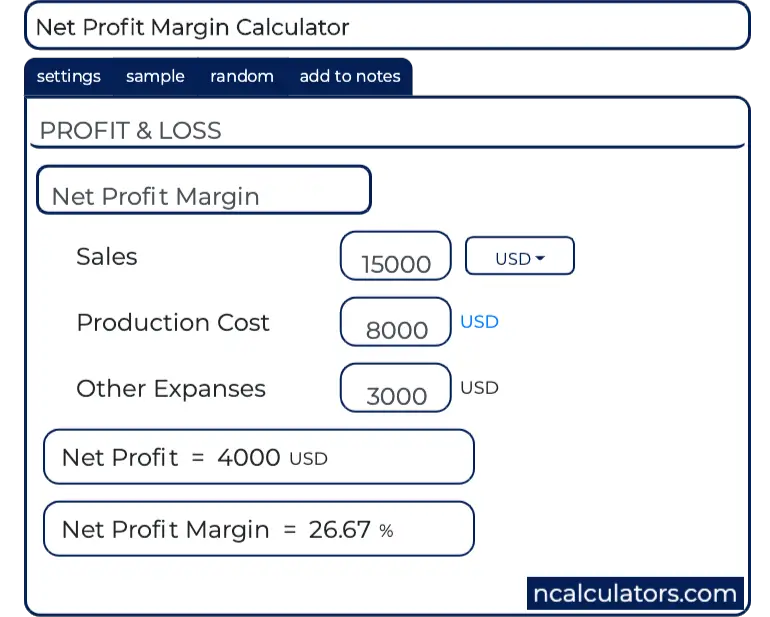

Net Profit Margin Calculator

In situations when you have supplies falling under various tax brackets in a.

. After-tax profit margin is the percentage of revenue remaining after all operating expenses interest. Profit Margin Calculator For GST-Exclusive inputs. Revenue 200 million.

Rates subject to change. Net profit margin calculator measures companys profitability or how much of each dollar earned by the company is translated into net profitsNet profit margin formula is. Earnings Before Taxes EBT Net Income Taxes EBT can sometimes be found on the income statement.

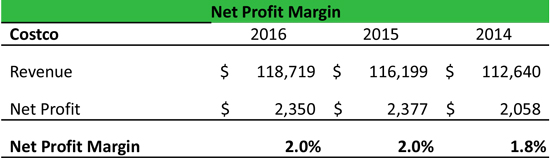

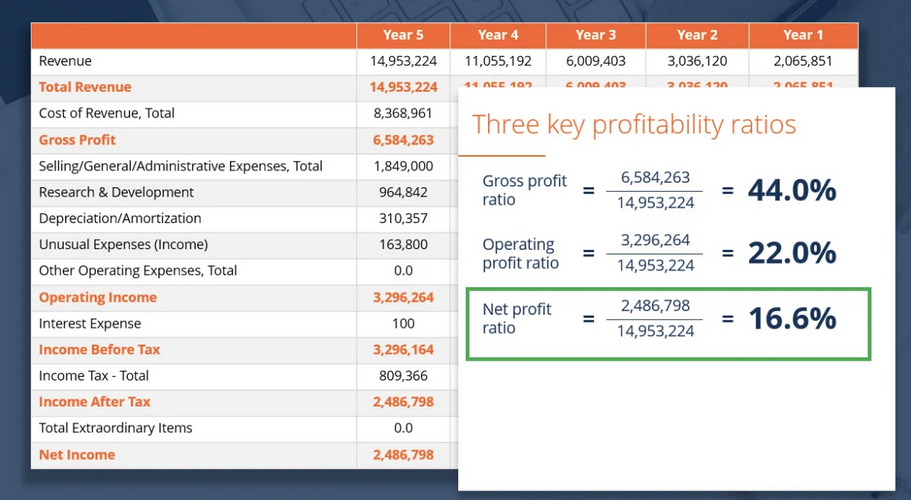

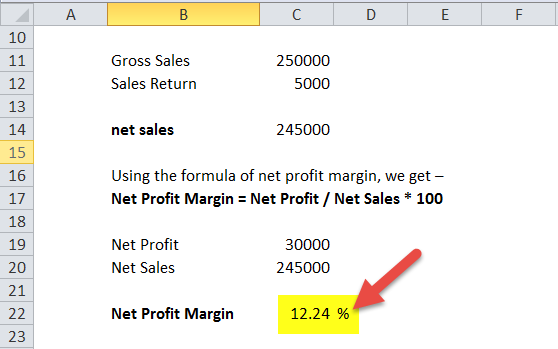

This calculates the percentage growth rate between the two time periods. On the basis of the above financial figures we can calculate the net profit margin for FY2018 by using the formula. Operating profit margin is what you keep after expenses but before taxes or interest.

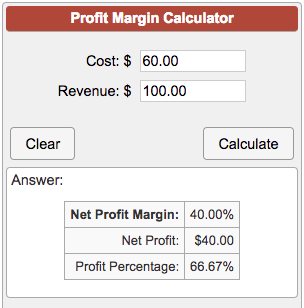

Margin rates as low as 283. After-tax profit margin is a financial performance ratio calculated by dividing net profit after taxes by revenue. Net Profit Margin Net Income Revenue.

They are also called return on. Take your net income and divide it by sales or revenue sometimes called the top line. The net operating profit after tax calculator calculates the after-tax profit from the operations of a company.

A companys after-tax profit margin is important because it tells. Using the formula and the information above we can calculate that. The net profit margin calculation is simple.

Calculation of net profit. The ratio can be calculated using the following equation. Gross profit margin is the amount of money a business makes after deducting the cost of the goods sold COGS.

Net Income 40 million. To clarify net operating profit is net earnings generated from the. Place these amounts in the formula.

Divide the difference by the previous periods PAT then multiply by 100. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. This calculator has been designed for GST exclusive inputs.

The formula for calculating gross profit is very simple. These three profit margin ratios indicate how much profit the company makes for every dollar of sales at each level. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

Total Revenue INR 500. Net Profit INR 30. Rates subject to change.

For example if your sales are 1 million and your net. On the basis of the above financial figures we can calculate the net profit margin for FY2018 by using the formula. EBT 50 million.

Total Revenue INR 500. Net profit margin is the percentage of income that you keep after all expenses taxes and interest are. Production operations and bottom line.

Margin rates as low as 283.

Net Profit Margin Calculator Bdc Ca

Net Profit Margin Formula Example Calculation

Performance Profits How To Calculate Your Small Business S Margin Mila Lifestyle Accessories

Guide To Profit Margin How To Calculate Profit Margins With Examples

After Tax Profit Margin Definition And Meaning Market Business News

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Margin Calculator

Net Profit Margin Calculator

Profit Percentage Formula Examples With Excel Template

Net Profit Ratio Double Entry Bookkeeping

Net Profit Margin Definition Formula How To Calculate

Net Profit Margin Calculator Bdc Ca

Profit Margin Formula Calculator Examples With Excel Template

Net Profit Margin Formula And Ratio Calculator Excel Template

Pretax Profit Margin Formula Meaning Example And Interpretation

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit After Tax Definition Formula How To Calculate Net Profit After Tax